Stuck or worried about the deposit and withdrawal processes at an online bookmakers? No problem. We'll walk you through both.

- How To Withdraw From Tab Online Account Login

- How To Withdraw From My Tab Account

- How To Withdraw From Tab Online Account Online

- How Do I Withdraw Money From My Tab Account

- How To Withdraw Money From Tab Online Account

- How To Withdraw From Tab Online Account

Note: processes are very similar for the different bookmakers and as such, the below step-by-step guides should be enough to get you through.

- When you want to transfer earnings to your bitcoin wallet, just click «Withdraw BTC» button in the drop-down box at the top right side of the main page and put down your bitcoin wallet number (You need to sign in using one of the social networks account before it).

- You can also open up a NOW checking account with TAB Bank and access your money by check or debit card. Transfers and guaranteed deposits can be made online or via customer service, giving you instant access to those funds. You can access your account information online at www.tabbank.com anytime.

How To Deposit At A Betting Site:

Bet live and online with TAB, Australia's number 1 racing and sports betting website. Get the latest odds on all horse racing, AFL, NRL, EPL, NBA & more here!

The following shows you how the deposit process works at Betvictor, it is similar at all bookmakers, but be aware there may be an extra set if you are using an e-wallt such as PayPal or Neteller:

- Head to Betvictor.com and log in by entering your username and password at the top right of the page and clicking ‘Go'.

- Click on the small yellow ‘Deposit' link which will now be displayed beneath your username at the top right of the page.

- Choose the ‘Credit/Debit Card' option from the drop down menu at the head of the form which will now have appeared on screen.

- Fill out the rest of the fields on the same form with information pertinent to your deposit, including the deposit amount and any deposit limits you may wish to set.

- Click the green ‘Make Deposit' button found beneath the form and its terms and conditions.

Deposit FAQ's

Are There Fees Applied to Deposits?

Fortunately, the answer to this question is a resounding no in the case of the vast majority of online bookmakers. If you stick to those providers reviewed by us on this site, certainly, you should hardly ever encounter deposit fees for the most popular deposit methods. In the few cases where fees are applied, they are unlikely to exceed 1-2%.

How Long Does Depositing Funds Take?

As shown by the above guide, the actual process for depositing should never take more than a couple of minutes. For most deposit methods, too, funds should appear in your account instantly once the process is complete. The only exceptions to that can be in the case of bank or wire transfers which can take up to a few days to process fully.

Is There a Minimum Deposit Amount?

Most bookmakers do have a minimum deposit amount and this does differ from one to the next and from one deposit method to another. In general, however, the minimum required for the most reputable bookmakers and the most popular deposit methods is usually either £5 or £10.

Is There a Maximum Deposit Amount?

Once again, deposit maximums are also invariably applied by bookmakers and do differ according to the bookmaker and the deposit method. With the biggest bookmakers, however, they are generally quite high and can run into the tens of thousands of pounds.

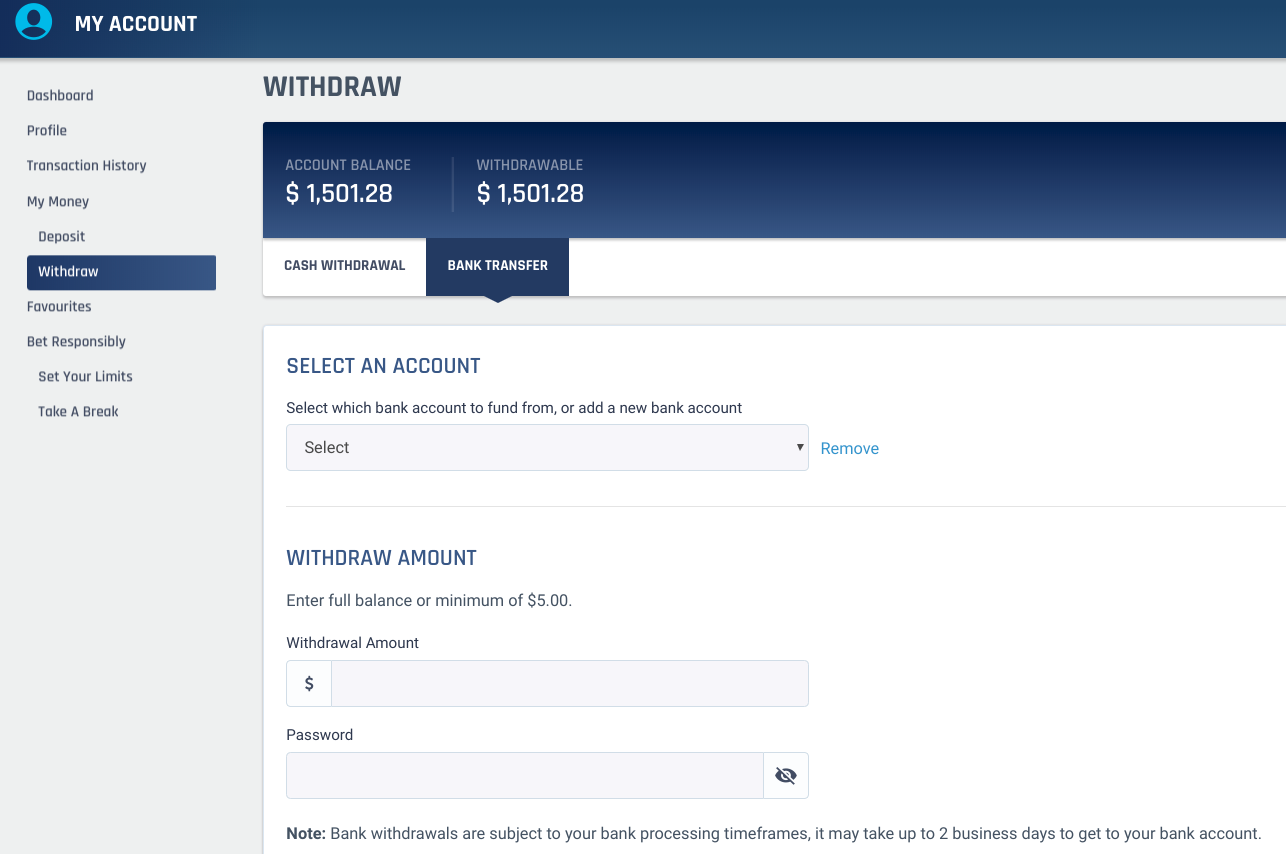

How To Withdraw From An Online Bookmaker:

Once again, the process is quite simple and differs little from bookie to bookie. The below guide to withdrawing for Betvictor but should be usable for all bookmakers:

- Log into your account by entering your username and password at the top right of the Betvictor homepage and clicking ‘Go'.

- Click the ‘Services' drop down menu found immediately beneath where your username and account balance is now displayed at the top right of the page.

- Click the ‘Withdraw' option from that menu.

- The withdrawal method which matches your initial deposit method will automatically be selected (i.e. if you deposited by debit card, withdrawing to your debit card will be the option displayed).

- Enter your desired withdrawal amount and other requested information into the dialogue boxes provided and click the green ‘Make Withdrawal' button.

Withdrawal FAQ's

Many of the most popular bookmakers do not apply any fees to withdrawals made via the most common withdrawal methods. For withdrawals by debit card, for instance, basically none of the best known bookmakers charge any fees. Where fees can be applied, however, is if unusual withdrawal methods such as wire transfers are requested for relatively small amounts of money.

Once a customer has complete the actual withdrawal process which takes just a couple of minutes, the amount of time they will have to wait until their funds are fully available to them will differ according to their withdrawal method. In general, e-wallet withdrawal methods such as Paypal or Neteller will see funds clear within 24 hours. Debit or credit card withdrawals, meanwhile, will often take anywhere from 1-5 working days, whilst bank or wire transfers can take even longer still.

Much like minimum bet amounts, the answer to this does vary from bookmaker to bookmaker. Largely, however, minimum withdrawal amounts for the most common withdrawal methods are in line with the corresponding minimum deposit amounts – being around £5 – £10.

Similarly to minimum withdrawals, maximum withdrawals also tend to differ according to the individual bookmaker in question. Once again, however, each withdrawal method's maximum amount tends to match the maximum possible deposit amount for that method. In the case of the most popular methods, therefore, this tends to be in the tens of thousands of pounds.

Work in transportation?

How To Withdraw From Tab Online Account Login

If you're looking for an innovative online-only banking experience, a high-yield savings account from TAB Bank (Transportation Alliance Bank) may be a good option for you… because right now they are offering one of the highest annual percentage yields in the market at 0.65%!

TAB Bank has been in operation since 1998 and specialize in offering service to the transportation industry. TAB Bank has, 'been working relentlessly to help people build businesses, turn ideas into action, capitalize on opportunities and capture their piece of the American dream.' These days most consumers want a user-friendly saving experience that will give them a significant return on their investment… and TAB Bank certainly raises the bar to a higher standard with the no muss no fuss features that they have implemented into their banking experience.

Read more below to find out if this latest high-yield savings account might be a good fit for you.

What Is A High-Yield Savings Account From TAB Bank?

TAB Bank (Transportation Alliance Bank) is an online-only bank currently offering a high-yield savings account with an incredible 0.65% annual percentage yield (APY). There is no minimum opening deposit required and all you need to have in your account to receive the advertised APY is just $1. No maintenance fees and no balance caps either. The best news is that your money is FDIC-insured and always available to you via mobile and online banking. There is also an option to pair your savings with a checking account to be able to access your money via ATM as well. Interest in the high-yield TAB Bank savings accounts are compounded daily and paid monthly.

How Can I Deposit and Withdraw Money from A TAB Bank High-Yield Savings Account?

Here are the ways TAB Bank says you can deposit or obtain money from your online savings account:

Deposits

- Direct deposits

- Online transfers

- Mobile check deposit

- Send a check via mail

- Wire transfers

Withdrawals

- Online transfers

- Wire transfers

- Request a check be mailed to you

What are the Account Fees For A TAB Bank High-Yield Savings Account?

Here is the current fee schedule for TAB High-Yield Savings Accounts:

What Are The Benefits of A TAB Bank High-Yield Savings Account?

- High APY

- FDIC-insured

- No minimum opening deposit required

- No monthly or annual maintenance fees

- Online and mobile banking options

- No balance caps

- You only need to have $1 in the account to receive the advertised APY

- Interest is compounded daily

What Are The Disadvantages of A TAB Bank High-Yield Savings Account?

- Limited to 6 withdrawals or outgoing transfers per billing cycle

- While 0.65% is one of the highest APYs in the market today – there are still a few banks that offer higher or may have better perks.

As of March 2021, here are some rates from competitors that you may want to check out:

- Aspiration Bank – 1.00% APY

- TAB Bank – 0.65 % APY

- First Foundation Bank Online Savings – 0.60% APY

- Vio Bank – 0.57% APY

- CIBC Bank – 0.52% APY

- Ally Bank – 0.50% APY

- American Express Personal Savings – 0.50% APY

- Citi Accelerate – 0.50% APY

- Goldman Sachs – Marcus Account – 0.50% APY

- Synchrony Bank – 0.50% APY

- TIAA Bank – 0.50% APY

- Barclays Bank – 0.40% APY

- Capital One 360 Performance Savings – 0.40% APY

- CIT Bank Savings Builder – 0.40% APY

- Citizens Access – 0.40% APY

- Discover – 0.40% APY

- MySavingsDirect – 0.25% APY

- HSBC Direct – 0.15% APY

Is A TAB High-Yield Savings Account FDIC-Insured?

Yes. TAB Bank is a FDIC member, which means that funds deposited into their high-yield savings accounts are insured up to the maximum allowed by law.

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation providing deposit insurance to depositors in U.S. commercial banks and savings institutions. The FDIC insures deposits according to ownership category (such as individual, joint or accounts with beneficiaries). The current maximum amount is $250,000 per depositor, per insured bank, for each account ownership category.

How Do You Open A TAB Bank High-Yield Savings Account ?

Opening a TAB Bank high-yield savings account is an easy, straightforward process. You just need to be at least 18 years old with a US mailing address and social security number to sign up.

- Visit TABbank.com.

- Hover over the 'Personal' tab

- Select High-Yield Savings

- Click Open Now

- You'll be prompted to select the type of account you will want to open – which is the 'High-yield savings'

- Enter your personal details

- Fund your account

How To Access Your TAB Bank High-Yield Savings Account:

Online: Access your account by logging in with your username and password on: TABbank.com

Mobile Device: Bank on your phone/tablet through their mobile app.

How To Withdraw From My Tab Account

Contact TAB Bank About your Account:

- Phone: (800) 355-3063

- Fax : (801) 624-5304

- Email: info@tabbank.com

- Customer service hours of operation are 6 a.m. to 7 p.m. (Mountain), Monday through Friday.

- 9 a.m. to 3 p.m. (Mountain) on Saturday.

- Federal holidays are excluded.

- Physical Mailing Address: 4185 HARRISON BLVD. OGDEN, UT 84403

Bottom Line

If you work in the transportation industry and would like to open a savings account that will give you a significant return on your investment – look no further than the high-yield savings account offered by TAB Bank. Sure, it's not the highest APY in the market right now, but with your working background, they've tailored their banking products and services to your specific needs.

Banking Health Score

There are many banks and financial institutions to choose from and it is important to be able to distinguish the good from the bad. Our team reviews each bank on a monthly basis to ensure that the information we share is as up to date as possible. Not only is the financial strength of a company important, but also how well their customer service is rated by actual customers like you.

We also believe that in order to determine how well a bank is functioning, that several sources should be utilized to compare one bank to another.

That said, here is a list of scores from trusted sources that you should consider before making your banking decisions.

How To Withdraw From Tab Online Account Online

TAB Bank – Bank Health Scores

Bank Professor's Bank Score = ⭐⭐⭐⭐ 4 stars out of 5 stars

Deposit FAQ's

Are There Fees Applied to Deposits?

Fortunately, the answer to this question is a resounding no in the case of the vast majority of online bookmakers. If you stick to those providers reviewed by us on this site, certainly, you should hardly ever encounter deposit fees for the most popular deposit methods. In the few cases where fees are applied, they are unlikely to exceed 1-2%.

How Long Does Depositing Funds Take?

As shown by the above guide, the actual process for depositing should never take more than a couple of minutes. For most deposit methods, too, funds should appear in your account instantly once the process is complete. The only exceptions to that can be in the case of bank or wire transfers which can take up to a few days to process fully.

Is There a Minimum Deposit Amount?

Most bookmakers do have a minimum deposit amount and this does differ from one to the next and from one deposit method to another. In general, however, the minimum required for the most reputable bookmakers and the most popular deposit methods is usually either £5 or £10.

Is There a Maximum Deposit Amount?

Once again, deposit maximums are also invariably applied by bookmakers and do differ according to the bookmaker and the deposit method. With the biggest bookmakers, however, they are generally quite high and can run into the tens of thousands of pounds.

How To Withdraw From An Online Bookmaker:

Once again, the process is quite simple and differs little from bookie to bookie. The below guide to withdrawing for Betvictor but should be usable for all bookmakers:

- Log into your account by entering your username and password at the top right of the Betvictor homepage and clicking ‘Go'.

- Click the ‘Services' drop down menu found immediately beneath where your username and account balance is now displayed at the top right of the page.

- Click the ‘Withdraw' option from that menu.

- The withdrawal method which matches your initial deposit method will automatically be selected (i.e. if you deposited by debit card, withdrawing to your debit card will be the option displayed).

- Enter your desired withdrawal amount and other requested information into the dialogue boxes provided and click the green ‘Make Withdrawal' button.

Withdrawal FAQ's

Many of the most popular bookmakers do not apply any fees to withdrawals made via the most common withdrawal methods. For withdrawals by debit card, for instance, basically none of the best known bookmakers charge any fees. Where fees can be applied, however, is if unusual withdrawal methods such as wire transfers are requested for relatively small amounts of money.

Once a customer has complete the actual withdrawal process which takes just a couple of minutes, the amount of time they will have to wait until their funds are fully available to them will differ according to their withdrawal method. In general, e-wallet withdrawal methods such as Paypal or Neteller will see funds clear within 24 hours. Debit or credit card withdrawals, meanwhile, will often take anywhere from 1-5 working days, whilst bank or wire transfers can take even longer still.

Much like minimum bet amounts, the answer to this does vary from bookmaker to bookmaker. Largely, however, minimum withdrawal amounts for the most common withdrawal methods are in line with the corresponding minimum deposit amounts – being around £5 – £10.

Similarly to minimum withdrawals, maximum withdrawals also tend to differ according to the individual bookmaker in question. Once again, however, each withdrawal method's maximum amount tends to match the maximum possible deposit amount for that method. In the case of the most popular methods, therefore, this tends to be in the tens of thousands of pounds.

Work in transportation?

How To Withdraw From Tab Online Account Login

If you're looking for an innovative online-only banking experience, a high-yield savings account from TAB Bank (Transportation Alliance Bank) may be a good option for you… because right now they are offering one of the highest annual percentage yields in the market at 0.65%!

TAB Bank has been in operation since 1998 and specialize in offering service to the transportation industry. TAB Bank has, 'been working relentlessly to help people build businesses, turn ideas into action, capitalize on opportunities and capture their piece of the American dream.' These days most consumers want a user-friendly saving experience that will give them a significant return on their investment… and TAB Bank certainly raises the bar to a higher standard with the no muss no fuss features that they have implemented into their banking experience.

Read more below to find out if this latest high-yield savings account might be a good fit for you.

What Is A High-Yield Savings Account From TAB Bank?

TAB Bank (Transportation Alliance Bank) is an online-only bank currently offering a high-yield savings account with an incredible 0.65% annual percentage yield (APY). There is no minimum opening deposit required and all you need to have in your account to receive the advertised APY is just $1. No maintenance fees and no balance caps either. The best news is that your money is FDIC-insured and always available to you via mobile and online banking. There is also an option to pair your savings with a checking account to be able to access your money via ATM as well. Interest in the high-yield TAB Bank savings accounts are compounded daily and paid monthly.

How Can I Deposit and Withdraw Money from A TAB Bank High-Yield Savings Account?

Here are the ways TAB Bank says you can deposit or obtain money from your online savings account:

Deposits

- Direct deposits

- Online transfers

- Mobile check deposit

- Send a check via mail

- Wire transfers

Withdrawals

- Online transfers

- Wire transfers

- Request a check be mailed to you

What are the Account Fees For A TAB Bank High-Yield Savings Account?

Here is the current fee schedule for TAB High-Yield Savings Accounts:

What Are The Benefits of A TAB Bank High-Yield Savings Account?

- High APY

- FDIC-insured

- No minimum opening deposit required

- No monthly or annual maintenance fees

- Online and mobile banking options

- No balance caps

- You only need to have $1 in the account to receive the advertised APY

- Interest is compounded daily

What Are The Disadvantages of A TAB Bank High-Yield Savings Account?

- Limited to 6 withdrawals or outgoing transfers per billing cycle

- While 0.65% is one of the highest APYs in the market today – there are still a few banks that offer higher or may have better perks.

As of March 2021, here are some rates from competitors that you may want to check out:

- Aspiration Bank – 1.00% APY

- TAB Bank – 0.65 % APY

- First Foundation Bank Online Savings – 0.60% APY

- Vio Bank – 0.57% APY

- CIBC Bank – 0.52% APY

- Ally Bank – 0.50% APY

- American Express Personal Savings – 0.50% APY

- Citi Accelerate – 0.50% APY

- Goldman Sachs – Marcus Account – 0.50% APY

- Synchrony Bank – 0.50% APY

- TIAA Bank – 0.50% APY

- Barclays Bank – 0.40% APY

- Capital One 360 Performance Savings – 0.40% APY

- CIT Bank Savings Builder – 0.40% APY

- Citizens Access – 0.40% APY

- Discover – 0.40% APY

- MySavingsDirect – 0.25% APY

- HSBC Direct – 0.15% APY

Is A TAB High-Yield Savings Account FDIC-Insured?

Yes. TAB Bank is a FDIC member, which means that funds deposited into their high-yield savings accounts are insured up to the maximum allowed by law.

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation providing deposit insurance to depositors in U.S. commercial banks and savings institutions. The FDIC insures deposits according to ownership category (such as individual, joint or accounts with beneficiaries). The current maximum amount is $250,000 per depositor, per insured bank, for each account ownership category.

How Do You Open A TAB Bank High-Yield Savings Account ?

Opening a TAB Bank high-yield savings account is an easy, straightforward process. You just need to be at least 18 years old with a US mailing address and social security number to sign up.

- Visit TABbank.com.

- Hover over the 'Personal' tab

- Select High-Yield Savings

- Click Open Now

- You'll be prompted to select the type of account you will want to open – which is the 'High-yield savings'

- Enter your personal details

- Fund your account

How To Access Your TAB Bank High-Yield Savings Account:

Online: Access your account by logging in with your username and password on: TABbank.com

Mobile Device: Bank on your phone/tablet through their mobile app.

How To Withdraw From My Tab Account

Contact TAB Bank About your Account:

- Phone: (800) 355-3063

- Fax : (801) 624-5304

- Email: info@tabbank.com

- Customer service hours of operation are 6 a.m. to 7 p.m. (Mountain), Monday through Friday.

- 9 a.m. to 3 p.m. (Mountain) on Saturday.

- Federal holidays are excluded.

- Physical Mailing Address: 4185 HARRISON BLVD. OGDEN, UT 84403

Bottom Line

If you work in the transportation industry and would like to open a savings account that will give you a significant return on your investment – look no further than the high-yield savings account offered by TAB Bank. Sure, it's not the highest APY in the market right now, but with your working background, they've tailored their banking products and services to your specific needs.

Banking Health Score

There are many banks and financial institutions to choose from and it is important to be able to distinguish the good from the bad. Our team reviews each bank on a monthly basis to ensure that the information we share is as up to date as possible. Not only is the financial strength of a company important, but also how well their customer service is rated by actual customers like you.

We also believe that in order to determine how well a bank is functioning, that several sources should be utilized to compare one bank to another.

That said, here is a list of scores from trusted sources that you should consider before making your banking decisions.

How To Withdraw From Tab Online Account Online

TAB Bank – Bank Health Scores

Bank Professor's Bank Score = ⭐⭐⭐⭐ 4 stars out of 5 stars

How Do I Withdraw Money From My Tab Account

Additional Scores

- Bankrate's Safe and Sound Rating: 3.8 out of 5 stars

- BauerFinancial Star Rating: 4 out of 5 stars

- BankTracker Troubled Asset Ratio: 9.62

- FDIC: Actively insured

How To Withdraw Money From Tab Online Account

More about the rating system:

- BankProfessor rates banks monthly on a one-to-five scale based on revenue, net income, total assets, total equity, capital ratio, customer reviews, rating agency scores, profitability, and troubled asset ratio.

- Bankrate.com ranks banks and credit unions quarterly on a one- to five-star system, with one being the lowest rating and five the highest. The rating is given based on regulatory filings about the financial institution's capital adequacy, asset quality, profitability and level of cash available. It compares those levels with peer and industry norms.

- BauerFinancial offers a similar star rating system as Bankrate (a one- to five-star system, with one being the lowest rating and five the highest).

- BankTracker was created by the Investigative Reporting Workshop of American University and MSNBC.com. They determine a bank's troubled asset ratio. According to the site, the ratio is 'a strong indicator of severe stress inside a bank because it shows the bank's ability to withstand loan losses'. In other words, the higher the ratio, the more 'trouble' they are in.

How To Withdraw From Tab Online Account

Kate's career has focused on consumer behavior and marketing analysis. She is a Senior Staff Writer for BankProfessor.com.